The head of the Oscar-winning British animation studio Aardman has warned that British children’s television production will have to move overseas due to mounting challenges for the industry in the UK.

“Children’s television is suffering and what’s produced in this country will go off the edge of a cliff in the next couple of years, unless something is done,” Sean Clarke, managing director of Aardman, told The Guardian. “The ideas will still be conceived here, but they’ll be made elsewhere.”

Clarke revealed Aardman is struggling with factors ranging from serious competition from other countries on tax relief, to a skills shortage here in the UK.

On animation tax relief, the UK rates have become less competitive recently. Where it stands at 25 per cent in Britain, countries such as Ireland, France, Canada and Spain’s Canary Islands offer relief between 37 and 50 per cent.

“I have the Spanish calling me all the time, saying: ‘Why don’t you come to the Canaries, where it’s up to 50%?’ We have to consider it,” Clarke said.

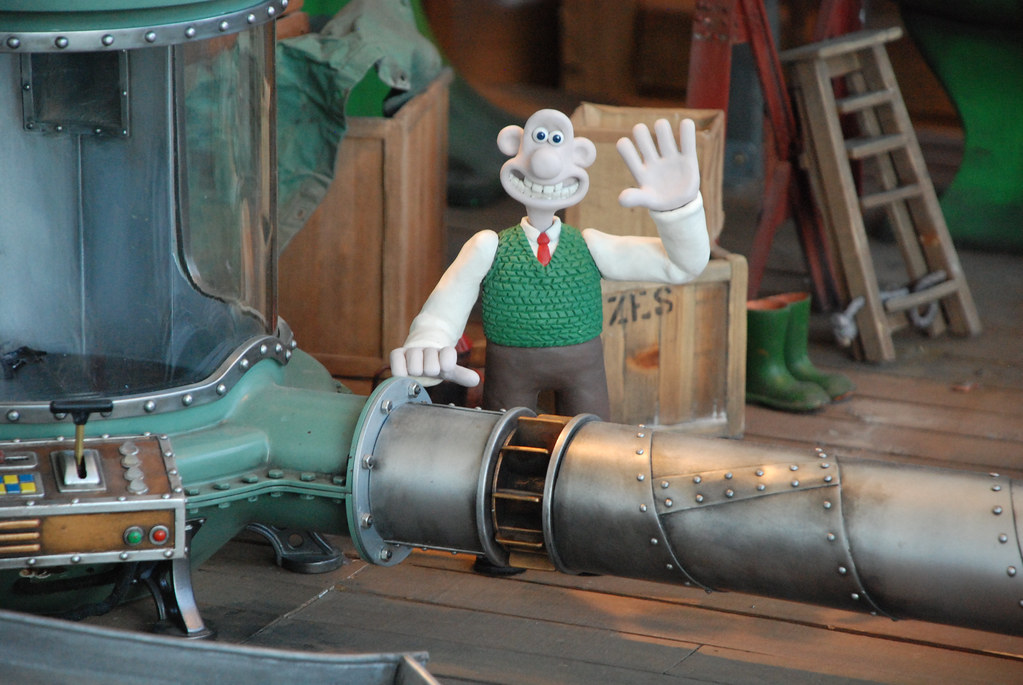

Then prime minister David Cameron visits the Aardman Animations studios in Bristol

Aardman was founded by Peter Lord and David Sporxton on a kitchen table in Bristol over 40 years ago. They soon enlisted the help of Nick Park, who was then a student. Together, their creations include The Wallace & Gromit series, Chicken Run, Shaun the Sheep and Flushed Away. A sequel to Chicken Run is currently on the way, as is an immersive experience for Wallace & Gromit.

Clarke continued that making Aardman classics of yesteryear would be a very different proposition in the UK today.

“We created Shaun the Sheep 15 years ago and made 150 episodes. The landscape is now very different and if Aardman were starting today, it would be incredibly hard to produce Shaun the Sheep in this country.

“It’s a constant battle of how you raise money. It’s amplified at the moment because a lot of countries are more competitive with tax credits and they’re building infrastructure, both in terms of studios and training. Training is broken in this country. There is no infrastructure to train and nurture the next generation of talent for film and television generally.

“We’ve had to set up our own academy over the last 10 years to train people because graduates from colleges and universities are not production-ready.”

“If you don’t have access to funding, then you have to make your budgets smaller or you sell rights in your project. What you’d probably lose is that real innovation of someone like Aardman that said: ‘We’re going to make a children’s TV series around Shaun the Sheep and we’re going to push the barriers about doing a series where no one talks.’ When we did that, we were told ‘You can’t do that’, but we did, and it’s become incredibly successful.”

Clarke spoke out during a government conducted consultation on audio-visual tax reliefs. That consultation is due to close this Thursday, 9 February.

Kate O’Connor, head of the industry representing Animation UK, said: “Business challenges affecting the animation sector have changed dramatically. Other countries have put some eye-catching tax reliefs in place. We’re not asking for handouts, but to be competitive in the global marketplace.

“Tax relief is a fantastically useful fiscal lever, but the UK rate is wrong for animation. There’s huge investment going into animation globally, while there’s been declining investment in UK-originated content and diminishing programme hours on public service broadcasting channels …we’re just going to lose out.”